Received 2 March 2023; Revised 24 May 2023, 4 July 2023, 6 August 2023; Accepted 15 August 2023.

This is an open access paper under the CC BY license (https://creativecommons.org/licenses/by/4.0/legalcode).

Erum Shaikh, Ph.D. in Business Administration, Assistant Professor of the Department of Business Administration, Shaheed Benazir Bhutto University, Sanghar Campus, Sindh, Pakistan, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Muhammad Nawaz Tunio, Ph.D. in Entrepreneurship, Innovation and Economic Development, Assistant Professor of the Department of Business Administration, University of Sufism and Modern Sciences, Bhitshah, Sindh, Pakistan, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Vishal Dagar, Ph.D. in Economics, Assistant Professor of the Department of Economics, Amity School of Economics, Amity University, Noida – 201 301, India, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Abstract

PURPOSE: By bridging the funding gap between funding surplus units and deficit units, financial institutions like banks play a crucial role in fostering economic development in a nation. Banks provide the crucial task of organizing individual and institutional resources and directing them to those prepared to engage in business ventures or other productive uses. The aim of this paper is to evaluate the relation between funding liquidity and bank lending growth (BLG). An empirical analysis between bank capital and the funding liquidity ratio on bank lending growth (BLG) using the generalized method of moments (GMM) approach for the sustainable business has been not identified before. Therefore, this study tries to fill this gap. METHODOLOGY: The data was collected from 59 commercial banks in India from 2010 to 2022 which comprises of 21 public sector banks, 18 private sector banks, and 20 foreign banks. The GMM approach was what we employed. This strategy is typically utilized in situations in which the distribution of the data is uncertain and there is a concern with over identification. GMM offers a consistent, asymptotically normal, and efficient estimator in comparison to all of the other estimators that merely use the information presented by the moment conditions. FINDINGS: Findings suggests that there is a significantly negative influence of bank capital and funding liquidity on bank lending. This indicates that higher capital can limit the effect of funding liquidity on the growth of the banks’ loans, therefore the findings are consistent with the hypothesis that higher capital can lower the effect of funding liquidity. This study’s model also reveals the significantly favorable impact that funding liquidity has on the expansion of banks’ loan portfolios, which ultimately results in a more sophisticated increase in the growth rate of bank lending. IMPLICATIONS: This can be an importance piece of information for policy makers in taking accurate decisions to induce the BLG in the presence of an interactive association of funding liquidity and the lending growth rate at different capital levels. We found that the banks’ lending growth rate is significantly influenced by its past values with a significant p-value of less than 1%. The findings imply that capital funds and liquidity funds support the BLG rate in India by strengthening and neutralising the risk involved and absorbing the losses generated by stressed assets. ORIGINALITY AND VALUE: This study makes a significant contribution to the creation of a more in-depth understanding of the potential relationship between banks’ funding liquidity, capital funds, and bankers’ lending behavior, in particular with reference to developing market nations like India.

Keywords: funding liquidity, generalized method of moments, GMM, system GMM, bank capital, bank lending growth, liquidity

INTRODUCTION

This study aims to find out the relation between Funding Liquidity and Bank Lending Growth (BLG). In order to answer this question, a quantitative approach was used to collect and analyze the data. This study can be useful for the financial institutions of India and international institutions, which have an impact on the economy of the country and its international trade. India is a vibrant and emerging economy in the region and has international importance because of its tourism, film industry, and technological growth. Therefore, India was chosen for this study, and emerging scholars, research students, think tanks, policy makers, and financial analysts can be the greater audience.

Financial institutions like banks play a pivotal role in fuelling the economic development of a country by bridging the gap between funding surplus units and deficit units. Banks serve the essential function of mobilizing the savings of individuals and institutions, and channelling them to those individuals and institutions willing to invest in economic activities or in other productive use. Both the existing theoretical and empirical literature suggest that bank lending is a fundamental process that fuels economic growth by creating jobs, fulfilling demands, and thereby enhancing the living standard of people. Moreover, banks create liquidity during this transformation process by holding illiquid assets, financing long-term bank assets (loans) with short term liabilities (bank deposits), and fulfilling the liquidity requirements of an economy (Diamond & Dybvig, 1983; Staszkiewicz & Werner, 2021). This transition at times, may leave banks susceptible to funding liquidity risk when these long-term assets and short-term liabilities misalign. Nevertheless, this misalignment, which is known as funding liquidity risk in the theory of banking, is known to have played a key role in nearly all historical banking crises. Evidently, the global financial crisis of 2007–2009 illustrated how a funding liquidity crisis led to a severe inter-market collapse (Drehmann & Nikolaou, 2013; Bhattarai & Subedi, 2021).

In the upshot of the global financial crisis of 2007–2009, bank liquidity became one of the prominently explored areas for setting up global financial regulatory reforms. The Basel III accord (2010) introduced new liquidity coverage ratios, capital regulations, and net stable funding ratio measures to ensure the stability and soundness of banking systems and do away with the dangers of liquidity crunches in the short run. However, it was uncertain whether the new funding liquidity requirements and other crucial capital regulatory reforms would ensure the stability of the banking sector in the long run (Fidrmuc & Lind, 2020; Basten, 2020; Nguyen et al., 2019; Allen et al., 2012; Singh, 2019). Many academicians argued that the regulatory reforms may prove to be a costlier precaution than handling a financial crisis after it has taken place.

As far as role of liquidity is concerned, the literature strongly supports that it plays a key role in the stability and soundness of the banking industry. However, the source of liquidity redefines their interrelations and magnitude of impact on its performance in different business cycle horizons. Brunnermeier and Pedersen (2009) in their study found a mutually reinforcing association between market liquidity and funding liquidity. That is, if banks face a phenomenon of tight funding liquidity, they become reluctant to take capital intensive positions even in high edge securities. This eventually cuts market liquidity and leads to even higher volatility, which in turn increases the cost of lending given the Basel III regulatory norms that are in place.

The global financial environment has recently gone through an overall downfall due to volatile crude prices, geographical tensions, and escalating trade wars. As far as other emerging market economies (EMEs), banks profitability has been impinged due to the weak loan growth and high delinquencies. To address the situation, monetary policies have turned to be accommodative and no more regulative, so as to counter the global slowdown and prevent its deepening in their respective countries. Moreover, to get aligned with Basel III requirements, building up bank capital and liquidity buffers are the crucial on-going regulatory reforms all over the world. At the same time, witnessing the fall in bank lending and other financial fragility globally, this has attracted most of the research in the area.

Moreover, as far as availability of funding liquidity and its impact over the lending behavior of banks is concerned, very little is known to date. On the one hand, there is considerable agreement that it significantly moderates commercial banks’ lending (Dahir et al., 2018a; Mor et al., 2020; Yusoff et al., 2021), while on the other hand, a large amount of literature exists that does not support the fact and states that funding liquidity exerts a moderate impact on bank lending. However, there are no established relationships that have been identified between these variables to date. The impact of funding liquidity on the lending growth rate in developed countries and BRICS (Brazil, Russia, India, China, and South Africa) countries taken together is significantly negative, whereas the same is insignificant for many emerging market economies, including India. To fill this existing gap in the literature, we have undertaken this study to develop a better understanding of the potential relation between banks funding liquidity, capital funds and bankers’ lending behavior, especially in reference to emerging market economies like India. In this context, funding liquidity is considered to be the ability of an individual bank to arrange funds as and when the agreed-upon payments become due with no extra cost incurred (Drehmann & Nikolaou, 2013).

Overview of lending practices of Indian commercial banks

The Indian economy is engrossed by unprecedented economic slowdown and financial fragility in the recent past, which has caused a sharp decline in real fixed investments induced by a sluggish growth of real consumption in the country. Deceleration in the bank lending growth (BLG) rate is witnessed across all major non-food credit segments, mostly in the service sector. Credit growth rate to the MSME (micro, small, and medium enterprises) sector has eventually turned negative (Economic Survey, 2019–20). Apart from the repercussions of other empirically tested explanatory factors, such decline can also be attributed to the growing risk aversion of banks and built up NPAs (non-performing assets), despite the admission of more than 2000 industry insolvency resolutions since 2017. Moreover, monetary transmission remained weak during this period on all three accounts viz. rate structure, term structure and credit growth (Kumar, 2020).

Recent improvements in the asset quality and profitability of the banking sector are at an amorphous stage. In 2017–18, RBI put forward a revised framework with the Insolvency and Bankruptcy Code (IBC) as a focal point in the pursuit of declogging banks’ balance sheets from the overhang of stressed assets. The capital ratios of public sector banks have witnessed an improvement due to recapitalization. To summarise, it can be said that the Indian banking sector is supposed to be stronger due to extra capital cushions for shock absorption, a more stable liquidity status, and streamlining of stressed assets. Confoundingly, on the other hand, banks seem to be reluctant to lend (RBI, 2019). This possible waning of confidence and reluctance to infuse lending can take a heavy toll on overall economic activities.

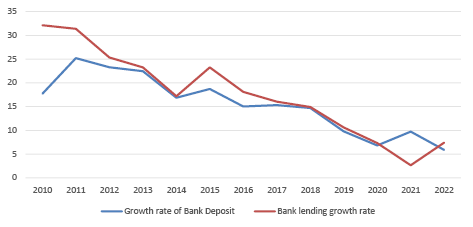

Figure 1 shows the bank lending growth rate and the growth of deposits in scheduled commercial banks in India over the years. The lending growth has constantly been falling and has been the lowest (i.e., 2.65 in 2021) when the deposit growth rates have shown converse trends, which can be associated with the fact that demonetization in the country led to people withdrawing large amounts from their bank savings accounts due to concerns about it losing its value. The lowest growth during this period could be explained by the reduced demand for consumption of durables and other luxury goods combined with a fall in demand for institutional loans by producers and industries. Also, post the global financial crisis, the Basel committee made stringent regulations about maintaining minimum capital and a liquidity coverage ratio, which led to a huge induction of capital and liquidity to the banking system all over the world, including the Indian banking sector, since 2016. However, it did not seem to have a positive impact on the BLG rate. Now, the question is, when the literature strongly suggests that capital and liquidity are expected to increase the BLG, why are the actual results varying from the bank theory?

Figure 1. Growth in bank lending and bank total deposits

Source: RBI database and author’s own calculations.

At this juncture, it becomes very important to analyze why recapitalization, insolvency and the bankruptcy code, and even regulatory reforms to improve the bank liquidity status, could not solve the problem of the reluctance of bankers to lend more. In our study we have tried to contribute to the on-going debate by bridging the gap between the existing literature and banks’ lending behavior in the real world.

The primary objectives of our study are to establish a relation between funding liquidity and BLG in the context of India and how the relation is being reiterated in the presence of bank capital. We have also established a relationship between bank capital and lending growth. The paper contributes to the literature in the following ways. Firstly, it checks the validity of the existing literature on the effect of funding liquidity, bank liquidity and bank capital on BLG and their implications in the context of India. We have also explored the iterations made by recapitalization on the association between funding liquidity and BLG in the context of India.

Our study bridges this gap by empirically testing the inter-relation hypothesis among funding liquidity, banks capital, and bank lending behavior of scheduled commercials banks in India. The remaining paper is organized as follows: Section II describes the review of the relevant literature. Section III and Section IV present the research methodology and discussion of empirical results, respectively. Section V reports the conclusion and policy implications.

LITERATURE REVIEW

The global financial crisis in 2007–2009 unveiled the phenomenon of regulatory and institutional shortcomings in liquidity risk management at individual institutions (IMF, 2010). A slowdown in global growth and domestic growth impulses in the recent past has also affected bank credit growth. The effects can also be viewed in many emerging markets economies (EMEs). Consequently, the global regulatory environment has undergone directive improvements in banks’ liability side items to strengthen the bank credit growth and thereby strengthen the overall economy. Bank regulators’ committees recognized the importance of bank capital and the availability of sufficient funding liquidity. In line with this, the Basel Committee introduced regulations to maintain appropriate liquidity and capital. The Basel III framework can be understood as an evolution, largely drawn from the existing Basel II framework, with the objective to build a strong capital base for banks and ensure comprehensive liquidity and leverage ratios to avoid a deepening of an ongoing slowdown or the early development of any financial fragility which can lead to a stressful financial crisis in the future. The underlined objective of the Basel III accords is to ensure the safety and stability of the global banking system.

There is growing literature on the factors affecting the bank credit growth in EMEs, particularly after the recent global financial crisis. The association of bank specific variables and macroeconomic variables with bank lending behavior has been immensely explored by many academicians. Matousek and Solomon (2018) empirically tested the dynamic effects of monetary shocks over the loans by large banks, highly liquid banks, and highly capitalized banks. They found that large banks and higher capitalized banks are comparatively less affected by monetary shocks, whereas the loan disbursement by highly liquid banks is not affected (Matousek & Solomon, 2018; Migliorelli, 2021). King et al. (1993) cite a significant association between the size of the financial system of the country and the level of the country’s economic development, emphasizing the increasing role of financial intermediation, in banks in particular (King & Levine, 1993).

Many studies have explored bank liquidity and the consequences of bank liquidity risk, but very few have talked about funding liquidity so far. The IMF Financial Stability Report 2010 defined funding liquidity as “the ability of a solvent institution to make agreed-upon payments in a timely fashion.” In other words, funding liquidity can be defined as the degree of freedom and economic efficiency in the borrowing of financial assets by financial institutions.

Acharya and Naqvi (2012) studied how macroeconomic risk alters the availability of funding liquidity with banks and thereby encourages them to invest in more risky assets. They argue that when there is high macroeconomic risk in the economy, investors avoid direct investments in the financial assets market – rather they perceive bank demandable deposits to be a safer outlay to invest with. Therefore, excessive liquidity induces more risk-taking behavior on the part of the bank (Acharya & Naqvi, 2012; Gatey & Strahan, 2006; Myers & Rajan, 1998).

Hugonnier and Morellec (2017) explored the relationship between bank capital, liquid reserves and insolvency risk, and found that the choice of bank policy for imposing liquidity requirements lowers the bank losses in default by increasing the likelihood of default. Whereas combining liquidity requirements with leverage requirements was found to reduce both the likelihood of default and the total bank losses in default.

As far as emerging economies are concerned, studies conducted on the analysis and implications of funding liquidity lack empirical evidence. Several of the recent studies talk about funding liquidity risk and its effects on bank lending behavior and its performance (Khan et al., 2017; Drehmann & Nikolaou, 2013; Umar & Sun, 2016; Dahir et al., 2018b; Motkuri & Mishra, 2020), but most of the propositions and hypotheses drawn have mostly been empirically tested on the banking systems of developed countries. A few which have empirically tested such propositions on BRICS countries or other EMEs like Vietnam and others, have broadly ignored the fact that some such EMEs (like India), which were slightly resilient to the recent global crisis, are likely to exert a different behavior (Dahir et al., 2018b)

Moreover, the joint effect of capital levels and funding liquidity on loan growth and the interaction effect of these two vital factors have been raised lately. Dahir et al. (2018b) explored such a relation in data pertaining to BRICS countries (Brazil, Russia, India, China, and South Africa) and paved the way for further exploration in this area. However, based on our empirical results, we found the conclusions are quite contradictory if tested on Indian commercial banks’ lending behavior. Averaging out of the variables from various BRICS countries seems to have created such implications.

To sum up, broadly the theories of empirical implications of funding liquidity on bank lending are based on developed economies and BRICS countries. These implications seem to veriate when tested for India. Based on these existing propositions, we have tested the following hypothesis4:

H1: Funding liquidity and banks’ lending behavior has a positive association in

the context of India.

Plenty of literature supports the hypotheses, suggesting the availability of sufficient deposits leads to an increase in the BLG (Acharya & Naqvi, 2012). In addition, evidence shows that adequate funding liquidity saves banks from possible exposure to a liquidity crisis, which may further lead to bank crises (Acharya & Merrouche, 2013). However, regulatory liquidity seems to have a contradictory impact over bank lending as it is a compulsory reserve that banks need to maintain, which in turn leads to reduce the lending (Korzeb & Samaniego-Medina, 2019). Thus, funding liquidity exerts a negative impact over the growth rate of bank lending.

H2: Banks with higher capital tend to increase their loan growth rate.

Košak et al. (2015) studied the impact of tier 1 capital and tier 2 capital on bank lending growth and reported a very interesting set of findings. The authors concluded that tier 1 capital had a significantly positive impact over bank lending during the recent financial crisis, whereas tier 2 capital did not show any such associations. In the same line, Ibrahim and Rizvi (2018) found no such significant impact of bank capital on their lending behavior during the 2007–2009 global financial crisis, under both the banking systems vis. the conventional banking system, as well as the Islamic banking system (Ibrahim & Rizvi, 2018). Therefore, the conventional literature on linkage between bank capital and BLG does seem conclusive.

However, Basten (2020) claimed that a higher bank capital requirement may cause a fall in the BLG rate as it evidently calls for a higher mortgage price. Also, a high capital requirement may affect the economy adversely as it prevents the extension of more lending (Fidrmuc & Lind, 2020; Karkowska, 2019).

H3: The impact of funding liquidity on BLG is positively associated with different

levels of bank capital.

The literature suggests that adding an interaction term to the analytical model greatly expands the understanding of the relationships among the variables in the model. Inclusion of an interaction term (i.e., capital) in an analytical model provides a better representation and understanding of the existing relationship between funding liquidity and BLG. We have attempted to analyze how the induction of more capital has affected the positive association between funding liquidity and BLG during the period 2010–2022 in India.

Not much work has been done so far on the integration effect of bank capital and funding liquidity. However, Dahir et al. (2018a) empirically tested the association between the effect of funding liquidity on the lending practices of bank and the level of bank capital in BRICS countries, and claimed that a fall in funding liquidity is positively associated with bank capital.

METHODOLOGY AND RESEARCH METHODS

In this section we present the econometric model and empirical estimations to examine the lending behavior of commercial banks in India. Moreover, we also discuss the data specifications and variable measures. Existing empirical work done on identifying factors determining an individual bank’s lending behavior over the years suggests a dynamic panel model. It is believed that the current year’s lending decisions are normally dynamic in nature, as previous years’ lending decisions, along with other explanatory variables, may affect their lending behaviors. Hence, to explore the bank lending behavior, we employed the dynamic panel data approach which is represented by the following equation:

Where blgit is BLG as a proxy for bank lending behavior, blgit-1 is lagged BLG of commercial banks chosen to study. fulit and pcapit represents the funding liquidity and the proxy for bank capital respectively. fulit*pcapit is an interaction variable, which intends to capture the effect of funding liquidity when banks are recapitalised and bank capital increases suddenly due to an external force.

Liquidity and bank size is measured by liqit and sizeit respectively. We also control the time effect in our model. Yt is the vector of the time effect for year 2010 to 2022. We have studied the impact of funding liquidity, bank capital and the interaction effect of bank capital and funding liquidity on BLG rate of banks in India. We have controlled the other bank specific variables like liquidity, bank size and other exogenous macroeconomic variable in our model. Anything kept constant or constrained in a research study is referred to as a control variable. Despite not being relevant to the study’s goals, this variable is controlled because it might have an impact on the results. Designing well-defined empirical testing of causal effects requires careful consideration of the selection of acceptable control variables (Whited et al., 2022; Abbas et al., 2023).

Estimation method

The inclusion of the lagged dependent variable as the explanatory variable allows dynamic adjustments in an econometric model. However, it gives rise to the problem of endogeneity as the lagged variable is correlated with the dependent variable. To take care of an endogeneity issue, Das (2019) suggested two alternative methods viz. instrumental variable (IV) methods and the generalised method of moments (GMM) to be very useful. Also, the GMM estimator has become very popular in the area of finance as it provides asymptotically efficient inference by using a minimal set of statistical assumptions.

The generalized method of moments (GMM), utilized to estimate the dynamic panel data and solve the endogeneity, heteroskedasticity and serial correlation problem, turns out to be a handy and useful instrument in the area of banking and finance. The estimator is also known as the Arellano-Bond estimator, used to estimate the dynamic panel models. It contains both the levels and the first difference GMM estimator. But when the variance of fixed effect term across observations is high or in cases when the stochastic process is approaching random walk, this estimator may produce biased results in finite samples. To address this problem, Blundell and Bond (1998) derived a condition in which the estimator allows an additional set of moment conditions. This configuration helps to improve the performance of estimators (Blundell & Bond, 1998).

Moreover, by removing the bias generated by panel models, system GMM is known for generating efficient and consistent estimates (Dahir et al., 2018a). It also allows the use of multiple instruments, which is one of the biggest advantages in the comprehensive analysis of the problem. The consistency of the system GMM estimator depends on two specification tests viz. the Sargan–Hansen test for over-identification restrictions and a serial correlation test of the error terms.

Furthermore, our paper covers a panel of 59 scheduled commercial banks comprising of 21 public sector banks, 18 private sector banks, and 20 foreign sector banks. The dataset is considered small; however, it has a balanced ownership representation.

Data measurement and estimation

In this section, definitions, abbreviations, variable estimations, and their expected signs have been discussed. Our sample consists of 59 scheduled commercial banks in India for the period 2010–2022. The data has been collected from the RBI databank. The final dataset is a strongly balance panel. Moreover, the original dataset included nearly 90 commercial banks including 26 public sector banks (six State Bank of India and associates were merged and converted to one bank in 2018), 21 private sector banks and 47 foreign banks for which the database was available for the years 2010 to 2022. However, we dropped banks that were closed during the study period or established in between to avoid the omitted and unnecessary data outliers. In doing so, the data became a strongly balanced panel of 59 banks having 12 years observations for each subunit.

We used the BLG rate (a proxy for bank lending behavior) as the dependent variable, following previous studies (Kim & Hohn, 2017; Ibrahim & Rizvi, 2018; Vo, 2018). The BLG rate can be defined as a variation of banks gross loans from year t to t-1 (Ibrahim & Rizvi, 2018; Vo, 2018).

The explanatory variables used in the model are funding liquidity and bank capital. Funding liquidity has been defined in the literature as the degree of freedom and economic efficiency in the borrowing of financial assets by financial institutions. It is related to the ability of a bank to pay-off the liability as and when they become due in a timely manner. To study its impact, we have taken the ratio of total bank deposits and total assets as the proxy for funding liquidity (Khan et al., 2017; Dahir et al., 2018a; Shaikh et al., 2021a; Shaikh et al., 2021b). Distinguin et al. (2013) suggest a negative and significant impact of funding liquidity on the lending behavior of banks in BRICS countries.

The ratio of total bank capital divided by total assets is used as the proxy for capital (Dahir et al., 2018a). The theoretical literature suggests a significant and positive impact of the capital ratio on the BLG rate of commercial banks (Fidrmuc & Lind, 2020; Karkowska, 2019; Govindarajo et al., 2021).

Moreover, bank size is expected to exert a significant association with bank lending behavior, funding liquidity, and bank capital. Hence, to analyze the partial effect of our explanatory variables, we took bank size as well as the liquidity ratio as the control variables. The literature suggests bank size is likely to have a positive impact on BLG (Dahir et al., 2018a; Dahir et al., 2018b). The natural log value of the total assets of the bank has been taken as the proxy for bank size. The liquidity ratio is calculated by dividing the liquid assets of the bank with the bank’s total assets (Diamond & Dybvig, 1983; Dahir et al., 2018a; Xiang et al., 2022; Raza et al., 2022).

The liquidity has been defined by the RBI as the sum total of cash with the bank, balances with the RBI, balances in current accounts with other banks, money at call and short notice, interbank placements (within 30 days), and security held under the heading “held for trading and available for sale.” Bank liquidity is expected to exert a positive impact on the BLG rate (Khan et al., 2017). Considering the macroeconomic variables like GDP growth rate, inflation level over the years and other time related disturbances, a time effect model has been employed. The time effect model captures the long-run, cross-section, invariant disturbances and produces unbiased results. Further interaction effects between funding liquidity and bank capital have been studied. Dahir et al. (2018b) examined such an effect on BRICS countries in their study using the LSDVC approach and found that the effect of a decrease in funding liquidity on BLG has a positive relation with bank capital.

RESULTS AND DISCUSSION

In this section, the descripted statistics and correlation matrix analysis of variables of interest are discussed. A detailed system GMM estimation results and robustness check estimators are also reported. Table 1 represents the descriptive statistics of bank lending behavior (BLG ratio) and the independent variables used in dynamic panel data analysis. Table describes the independent variable with a short description in column 1. These values of 767 observations are in ratio, except the natural log of total bank assets which is in crore.

Table 1. Summary statistics

|

Variable |

Description |

Mean |

Median |

Std Dev |

Minimum |

Maximum |

Observations |

|

blgit |

BLG (%) |

0.2268 |

0.1816 |

0.4802 |

-0.7607 |

9.5651 |

767 |

|

fulit |

Funding liquidity (ratio) |

0.7174 |

0.8066 |

0.1888 |

0.0692 |

0.9257 |

767 |

|

pcapit |

Capital (ratio) |

0.073023 |

0.098821 |

0.204871 |

-0.409020 |

0.328513 |

767 |

|

liqit |

Liquidity (ratio) |

0.1335 |

0.0843 |

0.1373 |

0.0156 |

0.7994 |

767 |

|

sizeit |

Natural log of bank assets (in crore) |

10.1840 |

10.7548 |

2.4132 |

3.4037 |

15.0553 |

767 |

It shows that the BLG has a mean value of 0.22, which is ranging from -0.76 to 9.56 with a standard deviation score of 0.48, suggesting that bank lending in India roughly grows at a 0.22 rate annually. The average funding liquidity is 71% with a variability 18.89% which is ranging between 6% and 92%. It suggests that there is a high degree of variation among the funding liquidity content in various banks. The capital has a 0.73 mean value ranging from -0.40 capital to 0.3285 and variability of 20.48%. The liquidity ratio, having an average value of 13.35% with variability of 13.73%, ranges from 1.56% to as high as 79.9%. Moreover, the size of the commercial banks in Indian seems to be quite stable as the mean and median values are very close to each other with a variability of 2.41 units. However, it ranges from 3.40 to 15.055, depicting a significant size difference among the public, private, and foreign bank holdings.

Table 2 reports the correlation matrix of the dependent and the independent variables. It describes that the dependent variable is negatively correlated with most of the variables in our study except bank capital, suggesting the BLG is expecting to have increasing trends when funding liquidity, bank liquidity, and size are reducing. Similarly, funding liquidity seems to have a negative correlation with bank capital and bank liquidity. Bank capital shows a positive association with BLG and bank liquidity, suggesting an increase in bank capital supports the BLG and bank liquidity to absorb the shocks.

Table 2. Correlation matrix analysis

|

Variable |

blgit |

fulit |

pcapit |

liqit |

sizeit |

|

blgit |

1 |

||||

|

fulit |

-0.14** (.829) |

1 |

|||

|

pcapit |

0.8** (.223) |

-0.65** (1.344) |

1 |

||

|

liqit |

-0.2** (1.334) |

-0.2** (1.343) |

0.4** (1.233) |

1 |

|

|

sizeit |

-0.1** (1.223) |

0.47** (0.3482) |

-0.7** (0.340) |

-0.65** (0.2338) |

1 |

Empirical linear regression analysis

Table 3 reports the results of our estimation model using the system GMM estimations. We had 708 observations (excluding the missing values), with 59 groups (banks) having 12 observations per group, indicating a strong panel. The model reports a Windmeijer bias-corrected (WC) robust standard error to ensure the robustness of estimators. The results indicate that the lagged dependent variable (BLGt-1) is positive and statistically significant at 1% significance level, suggesting that bank lending in Indian banks is sustained for the next year. It indicates the commercial banks in India are persistent as far as their lending decisions are concerned. As far as explanatory variables are concerned, bank capital and its interaction effect on the relation of funding liquidity with bank lending are significant at a 10% significance level.

It shows that bank capital indeed has a positive impact on bank lending and is also significantly associated with the relationship between funding liquidity and the banks’ lending decisions. Hence, we reject H1, which hypothesized a significant positive relation between funding liquidity and BLG. However, we do not reject H2, which postulates a positive and significant impact of bank capital on bank lending, suggesting an increase in bank capital significantly contributes to the further growth of bank lending. Also, we reject H3, which hypothesizes that the effect of funding liquidity on BLG is positively associated with the level of bank capital. The interaction effect of funding liquidity and bank capital on BLG is considerably greater than their individual effects.

Table 3. System GMM estimation results

|

blg |

Coeff. |

WC-Robust Std. Error |

t value |

p> t |

[95% confidence. Interval] |

|

|

Blgit-1 |

0.9885 |

0.2879 |

3.43 |

0.001*** |

0.4121 |

1.5649 |

|

Fulit-1 |

0.2297 |

0.2353 |

0.98 |

0.333 |

-0.2412 |

0.7008 |

|

Pcapit-1 |

5.1419 |

2.8270 |

1.82 |

0.074* |

-0.5170 |

10.8010 |

|

Liqit-1 |

0.9622 |

0.2548 |

3.78 |

0.000*** |

0.4529 |

1.4724 |

|

Fulit-1 *pcapit-1 |

-12.6430 |

6.6451 |

-1.90 |

0.062** |

-25.9448 |

0.6587 |

|

Sizeit-1 |

0.001853 |

0.0207 |

0.09 |

0.929 |

-0.0397 |

0.0434 |

|

Year |

||||||

|

2010 |

-0.1273 |

0.1382 |

-0.92 |

0.361 |

-0.4041 |

0.1494 |

|

2011 |

-0.2201 |

0.0978 |

-2.25 |

0.028** |

-0.4159 |

-0.0243 |

|

2012 |

-0.0016 |

0.1101 |

-0.02 |

0.988 |

-0.2221 |

0.2187 |

|

2013 |

0.1068 |

0.1166 |

0.92 |

0.364 |

-0.1266 |

0.3403 |

|

2014 |

-0.1810 |

0.1087 |

-1.66 |

0.101 |

-0.3987 |

0.0366 |

|

2015 |

-0.0745 |

0.1000 |

-0.75 |

0.459 |

-0.2748 |

0.1256 |

|

2016 |

-0.0658 |

0.1049 |

-0.63 |

0.533 |

-0.2759 |

0.1443 |

|

2017 |

-0.0395 |

0.1112 |

-0.36 |

0.724 |

-0.2622 |

0.1832 |

|

2018 |

-0.1081 |

0.1059 |

-1.02 |

0.312 |

-0.3202 |

0.1039 |

|

2019 |

-0.0293 |

0.1500 |

-0.20 |

0.846 |

-0.3297 |

0.2710 |

|

2020 |

0.0239 |

0.1463 |

0.16 |

0.871 |

-0.2690 |

0.3168 |

|

_cons |

-0.2067 |

0.3481 |

-0.59 |

0.555 |

-0.9036 |

0.4901 |

Note: * p<0.1, ** p< 0.05, ***p< 0.01.

A significant ρ-value of the interaction term coefficient depicts that the linear relationship between funding liquidity and BLG changes with a variation in the level of capital. Our results show that a high capital level reduces the effects of funding liquidity on BLG. This impact can be associated with the fact that the recent recapitalization of under-performing public sector banks could not increase their lending performance by much. The capital, so induced (given a resulting increase in funding liquidity in 2017 due to demonetization), was sufficient to meet the minimum capital maintenance regulations and had no significant positive impact over the correlation between funding liquidity and BLG. Moreover, the liquidity seems to exert a positive and highly significant impact with a 0 p-value, indicating the increase in bank liquidity leads to an increase in the BLG rate.

The theories revealed by earlier studies conducted on developed economies, other emerging market economies, and BRICS countries to check the impact of funding liquidity on bank lending, do not go in line with the Indian banking system. For example, Dahir et al. (2018b) found a significant and negative impact of funding liquidity on BLG; however, we found it to be insignificant (p-value 0.3330) and positive.

To check the robustness of the results, we have employed the WC robust standard error, which ensures the estimation is producing unbiased and robust results. To check the consistency of results given by system GMM estimations, the Sargan–Hansen test of over identification of instrument variables and a serial correlation test are performed. The Sargan–Hansen test for over-identification restrictions has been used to detect whether the model is well specified, by analyzing the overall validity of instruments used that shall not be correlated with the error term.

The null hypothesis for the Sargan–Hansen test is that over-identifying restrictions are valid. We do not reject the null hypothesis with chi2 (2) value 0.7203 (p-value 0.72) and chi2 (2) value 2.3502 (p-value 0.30) at 2 step weighting matrix and 3-step weighting matrix respectively. It implies that the model is appropriately specified. For the serial correlation test of the error terms we reject the null hypothesis, which states that there is no first order serial correlation (AR (1)) with a p-value of 0.0000 for order 1, whereas we do not reject the null hypothesis stating that the second order serial correlation does not exists in disturbances (AR (2)) with a p-value of 0.2045.

CONCLUSION

Commercial banks are the most important financial intermediaries because of their size and role in the financial markets. Hence, lending practices of commercial banks have a crucial and significant impact over the growth and development of industries and production units and thereby growth and development of the country. Considering India’s experiences with BLG and various key policy measures taken by policy makers in recent time, we have analyzed how the bank’s lending policy reacts to various levels of funding liquidity and capital. The findings suggest that there is a significantly negative impact of bank capital and funding liquidity on bank lending, which shows that higher capital can reduce the effect of funding liquidity on the loan growth of the banks. The model of this study also exposes the significantly positive impact of funding liquidity on the loan growth of the banks which leads to the sophisticated growth in bank lending growth rate. This study develops a better understanding of the potential relation between banks funding liquidity, capital funds and bankers’ lending behavior, especially in reference to emerging market economies like India.

Practical implications

The findings revealed that funding liquidity in the context of India does not have any significant impact on the banks’ lending behavior. Conversely, bank capital has a significant positive impact on bank lending, which suggests that an increase in capital increases the bank loan growth rate. Besides, bank liquidity also has a significant positive impact on the BLG rate, suggesting the banks’ lending rates improve with the increase in bank liquidity funds.

Theoretical implications

The presence of interaction effects in our model explains how funding liquidity and different levels of capital work together to determine the BLG of commercial banks in India. A significant value of β3 represents a strong positive impact of capital levels on the association of funding liquidity on BLG. It can be interpreted as the effect of funding liquidity on lending behavior of banks is different depending on different levels of bank capital. Further, we discovered that the impact of funding liquidity on such lending reduces at high capital levels. In other words, the impact of funding liquidity is significantly conditioned over the different levels of bank capital.

This can be an importance piece of information for policy makers in taking accurate decisions to induce the BLG in the presence of an interactive association of funding liquidity and the lending growth rate at different capital levels. Moreover, the inclusion of a lagged BLG rate as an explanatory variable allows us to check the impact of past lending practices of banks on the current year’s lending rate under the dynamic settings of the econometrics model. We found that the banks’ lending growth rate is significantly influenced by its past values, with a significant p-value of less than 1%. The findings imply that capital funds and liquidity funds support the BLG rate in India by strengthening and neutralizing the risk involved and absorbing the losses generated by stressed assets.

Furthermore, our study provides important implications for academicians and policy makers to appreciate the role of funding liquidity. Our future recommendations are to check more robustness of the model and that some macroeconomic variables can be added to this model.

Acknowledgments

All the authors have acknowledged the help received from their seniors with whom they encounter while performing this study.

Abbas, F., Ali, S., & Ahmad, M. (2023). Does economic growth affect the relationship between banks’ capital, liquidity and profitability: Empirical evidence from emerging economies. Journal of Economic and Administrative Sciences, 39(2), 366-381. https://doi.org/10.1108/JEAS-03-2021-0056

Acharya, V. V., & Merrouche, O. (2013). Precautionary hoarding of liquidity and interbank markets: Evidences from subprime crisis. Review of Finance, 17(1), 107-160. https://doi.org/10.1093/rof/rfs022

Acharya, V., & Naqvi, H. (2012). The seeds of a crisis: A theory of bank liquidity and risk taking over the business cycle. Journal of Financial Economics, 106(2), 349-366. https://doi.org/10.1016/j.jfineco.2012.05.014

Allen, B., Chan, K. K., Milne, A., & Thomas, S. (2012). Basel III: Is the cure worse than the disease? International Review of Financial Analysis, 25(5), 159-166. https://doi.org/10.1016/j.irfa.2012.08.004

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277-297. https://doi.org/10.2307/2297968

Basten, C. (2020). Higher bank capital requirements and mortgage pricing: Evidence from the counter-cyclical capital buffer. Review of Finance, 24(2), 453-495. https://doi.org/10.1093/rof/rfz009

Bhattarai, G., & Subedi, B. (2021). Impact of COVID-19 on FDIs, remittances and foreign aids: A case study of Nepal. Millennial Asia, 12(2), 145-161. https://doi.org/10.1177/0976399620974202

Blundell, R., & Bond, S. (1998) Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115-143. https://doi.org/10.1016/S0304-4076(98)00009-8

Dahir, A. M., Mahat, F. B., & Ali, N. A. B. (2018). Funding liquidity risk and bank risk-taking in BRICS countries: An application of system GMM approach. International Journal of Emerging Markets, 13(1), 231-248. https://doi.org/10.1108/IJoEM-03-2017-0086

Dahir, A. M., Mahat, F., Razak, N. H. A., & Bany-Ariffin, A. N. (2019). Capital, funding liquidity, and bank lending in emerging economies: An application of the LSDVC approach. Borsa Istanbul Review, 19(2), 139-148. https://doi.org/10.1016/j.bir.2018.08.002

Das, P. (2019). Econometrics in Theory and Practice. Analysis of Cross Section, Time Series and Panel Data with Stata 15.1. Singapore: Springer. https://doi.org/10.1007/978-981-32-9019-8

Diamond, D. W., & Dybvig, P. H. (1983). Bank runs, deposit insurance, and liquidity. Journal of Political Economy, 91(3), 401-419. https://doi.org/10.1086/261155

Distinguin, I., Roulet, C., & Tarazi, A. (2013). Bank regulatory capital and liquidity: Evidence from US and European publicly traded banks. Journal of Banking & Finance, 37(9), 3295-3317. https://doi.org/10.1016/j.jbankfin.2013.04.027

Drehmann, M., & Nikolaou, K. (2013). Funding liquidity risk: definition and measurement. Journal of Banking & Finance, 37(7), 2173-2182. https://doi.org/10.1016/j.jbankfin.2012.01.002

Fidrmuc, J., & Lind, R. (2020). Macroeconomic impact of Basel III: Evidence from a meta-analysis. Journal of Banking & Finance, 112(3), 105359. https://doi.org/10.1016/j.jbankfin.2018.05.017

Gatey, E., & Strahan, P. (2006). Banks, advantage in hedging liquidity risk: Theory and evidence from the commercial paper market. Journal of Finance, 61(2), 867-892. https://doi.org/10.1111/j.1540-6261.2006.00857.x

Government of India, Ministry of Finance. (2020). Economic Survey 2019-2020. New Delhi: India.

Govindarajo, N. S., Kumar, D., Shaikh, E., Kumar, M., & Kumar, P. (2021). Industry 4.0 and business policy development: Strategic imperatives for SME performance. Etikonomi, 20(2), 239-258. https://doi.org/10.15408/etk.v20i2.20143.

Hugonnier, J., & Morellec, E. (2017). Bank capital, liquid reserves and insolvency risk. Journal of Financial Economics, 125(2), 266-285. https://doi.org/10.1016/j.jfineco.2017.05.006

Ibrahim, M. H., & Rizvi, S. A. R. (2018). Bank lending, deposits and risk-taking in times of crisis: A panel analysis of Islamic and conventional banks. Emerging Markets Review, 35(2), 31-47. https://doi.org/10.1016/j.ememar.2017.12.003

IMF. (2010). Financial Stability Report International Monetary Fund, Washington, D.C., United States.

Karkowska, R. (2019). Business model as a concept of sustainability in the banking sector. Sustainability, 12(1), 1-1. https://doi.org/10.3390/su12010111

Khan, M. S., Scheule, H., & Wu, E. (2017). Funding liquidity and bank risk taking. Journal of Banking & Finance, 82(9), 203-216. https://doi.org/10.1016/j.jbankfin.2016.09.005

Kim, D., & Hohn, W. (2017). The effect of bank capital on lending: Does liquidity matter?. Journal of Banking and Finance, 77(4), 95-107. https://doi.org/10.1016/j.jbankfin.2017.01.011

King, R. G., & Levine, R. (1993). Finance, entrepreneurship and growth. Journal of Monetary Economics, 32(3), 513-542. https://doi.org/10.1016/0304-3932(93)90028-E

Korzeb, Z., & Samaniego-Medina, R. (2019). Sustainability performance. A comparative analysis in the polish banking sector. Sustainability, 11(3), 653. https://doi.org/10.3390/su11030653

Košak, M., Li, S., Lončarski, I., & Marinč, M. (2015). Quality of bank capital and bank lending behavior during the global financial crisis. International Review of Financial Analysis, 37(1), 168-183. https://doi.org/10.1016/j.irfa.2014.11.008

Kumar, V. (2020). Social innovation for agricultural development: A study of system of rice intensification in Bihar, India. Millennial Asia, 11(1), 99-118. https://doi.org/10.1177/0976399619900615

Matousek, R., & Solomon, H. (2018). Bank lending channel and monetary policy in Nigeria. Research in International Business and Finance, 45(3), 467-474. https://doi.org/10.1016/j.ribaf.2017.07.180

Migliorelli, M. (2021). What do we mean by sustainable finance? Assessing existing frameworks and policy risks. Sustainability, 13(2), 975. https://doi.org/10.3390/su13020975

Mor, S., Madan, S., Archer, G. R., & Ashta, A. (2020). Survival of the smallest: A study of microenterprises in Haryana, India. Millennial Asia, 11(1), 54-78. https://doi.org/10.1177/0976399619900609

Motkuri, V., & Mishra, U. S. (2020). Human resources in healthcare and health outcomes in India. Millennial Asia, 11(2), 133-159. https://doi.org/10.1177/0976399620926141

Myers, S., & Rajan, R. (1998). The paradox of liquidity. The Quarterly Journal of Economics, 113(3), 733-771. https://doi.org/10.1162/003355398555739

Nguyen, Q. T. T., Gan, C., & Li, Z. (2019). Bank capital regulation: How do Asian banks respond?. Pacific-Basin Finance Journal, 57(5), 101-196. https://doi.org/10.1016/j.pacfin.2019.101196

Raza, A., Shaikh, E., Tursoy, T., & Almashaqbeh, H. A. (2022). Economics and business perspectives of sustainable HRM. In Sustainable Development of Human Resources in a Globalization Period (pp. 36-48). IGI Global. https://doi.org/10.4018/978-1-6684-4981-3.ch003

RBI. (2019). Report on trends and progress of banking in India 2018-2019. Mumbai: Reserve Bank of India.

Shaikh, E., Mishra, V., Ahmed, F., Krishnan, D., & Dagar, V. (2021b). Exchange rate, stock price and trade volume in US-China trade war during COVID-19: An empirical study. Studies of Applied Economics, 39(8), 1-18. https://doi.org/10.25115/eea.v39i8.5327

Shaikh, E., Tunio, M.N., & Qureshi, F. (2021a). Finance and women’s entrepreneurship in DETEs: A literature review. Entrepreneurial Finance, Innovation and Development, 191-209. https://ssrn.com/abstract=4235550

Singh, S. (2019). Examining global competitiveness of Indian agribusiness in the twenty-first-century Asian context: Opportunities and challenges. Millennial Asia, 10(3), 299-321. https://doi.org/10.1177/09763996198798

Staszkiewicz, P., & Werner, A. (2021). Reporting and disclosure of investments in sustainable development. Sustainability, 13(2), 1-15. https://doi.org/10.3390/su13020908

Umar, M., & Sun, G. (2016). Interaction among funding liquidity, liquidity creation and stock liquidity of banks: Evidence from BRICS countries. Journal of Financial Regulation and Compliance, 24(4), 430-452. https://doi.org/10.1108/JFRC-11-2015-0062

Vo, X. V. (2018). Bank lending behavior in emerging markets. Finance Research Letters, 27(3), 129-134. https://doi.org/10.1016/j.frl.2018.02.011

Whited, R. L., Swanquist, Q. T., Shipman, J. E., & Moon Jr, J. R. (2022). Out of control: The (over) use of controls in accounting research. The Accounting Review, 97(3), 395-413. https://doi.org/10.2308/TAR-2019-0637

Xiang, H., Shaikh, E., Tunio, M. N., Watto, W. A., & Lyu, Y. (2022). Impact of corporate governance and CEO remuneration on bank capitalization strategies and payout decision in income shocks period. Frontiers in Psychology, 13(1), 901868. https://doi.org/10.3389/fpsyg.2022.901868

Yusoff, M. N. H. B., Zainol, F. A., Ismail, M., Redzuan, R. H., Abdul Rahim Merican, R. M., Razik, M. A., & Afthanorhan, A. (2021). The role of government financial support programmes, risk-taking propensity, and self-confidence on propensity in business ventures. Sustainability, 13(1), 1-16. https://doi.org/10.3390/su13010380

Abstrakt

CEL: Wypełniając lukę w finansowaniu pomiędzy jednostkami z nadwyżką a jednostkami z deficytem, instytucje finansowe, takie jak banki, odgrywają kluczową rolę we wspieraniu rozwoju gospodarczego kraju. Banki pełnią kluczowe zadanie organizowania zasobów indywidualnych i instytucjonalnych oraz kierowania ich do osób przygotowanych do zaangażowania się w przedsięwzięcia biznesowe lub inne produktywne zastosowania. Celem artykułu jest ocena związku pomiędzy płynnością finansowania a wzrostem akcji kredytowej banków (BLG). Nie przeprowadzono wcześniej analizy empirycznej pomiędzy kapitałem banku a wskaźnikiem płynności finansowania w odniesieniu do wzrostu akcji kredytowej banków (BLG) przy użyciu podejścia uogólnionej metody momentów (GMM) dla zrównoważonego biznesu. Dlatego niniejsze badanie stara się wypełnić tę lukę. METODYKA: Dane zebrano od 59 banków komercyjnych w Indiach w latach 2010–2022, w tym 21 banków sektora publicznego, 18 banków sektora prywatnego i 20 banków zagranicznych. Zastosowaliśmy podejście GMM. Strategię tę stosuje się zazwyczaj w sytuacjach, w których rozkład danych jest niepewny i istnieje obawa nadmiernej identyfikacji. GMM oferuje spójny, asymptotycznie normalny i efektywny estymator w porównaniu do wszystkich innych estymatorów, które jedynie korzystają z informacji przedstawionych przez warunki momentowe. WYNIKI: Wyniki sugerują, że istnieje znacząco negatywny wpływ kapitału banku i płynności finansowania na akcję kredytową banków. Wskazuje to, że wyższy kapitał może ograniczyć wpływ płynności finansowania na dynamikę kredytów banków, dlatego też wnioski są spójne z hipotezą, że wyższy kapitał może obniżyć wpływ płynności finansowania. Model zastosowany w tym badaniu ukazuje także znacząco korzystny wpływ płynności finansowania na ekspansję portfeli kredytowych banków, co ostatecznie skutkuje bardziej wyrafinowanym wzrostem dynamiki akcji kredytowej banków. IMPLIKACJE: Może to być ważna informacja dla decydentów przy podejmowaniu trafnych decyzji w celu skłonienia BLG w obecności interaktywnego powiązania płynności finansowania i stopy wzrostu akcji kredytowej na różnych poziomach kapitału. Ustaliliśmy, że na dynamikę akcji kredytowej banków istotny wpływ mają jej przeszłe wartości, przy istotnej wartości p poniżej 1%. Z ustaleń wynika, że fundusze kapitałowe i fundusze płynnościowe wspierają stopę BLG w Indiach poprzez wzmocnienie i neutralizację związanego z tym ryzyka oraz absorpcję strat generowanych przez aktywa obciążone trudnościami. ORYGINALNOŚĆ I WARTOŚĆ: Niniejsze badanie wnosi znaczący wkład w stworzenie bardziej dogłębnego zrozumienia potencjalnego związku między płynnością finansowania banków, funduszami kapitałowymi i zachowaniami bankierów w zakresie udzielania kredytów, w szczególności w odniesieniu do krajów rozwijających się, takich jak Indie.

Słowa kluczowe: płynność finansowania, uogólniona metoda momentów, GMM, systemowy GMM, kapitał banku, dynamika akcji kredytowej banków, płynność

Biographical notes

Erum Shaikh has a Ph.D. from Institute of Business Administration, University of Sindh, Jamshoro, Pakistan. She is currently working as an Assistant Professor and Head of Department at Department of Business Administration, Shaheed Benazir Bhutto University, Sanghar Campus. Her research interests are Corporate Social Responsibility, Finance, Entrepreneurship, Sustainability, Corporate Governance, Management and Entrepreneurial Finance. She has authored more than 30 publications (research papers, conference papers and book chapters) in the above-mentioned areas. She had edited two books and is the editor of five research journals. She has wide experience of teaching and administration and has served more than ten years in academics. She has organised and participated in several research conferences and research workshops as a keynote speaker, session Chair and guest speaker. She is a good teacher, researcher, speaker and trainer.

Muhammad Nawaz Tunio is Assistant Professor at the Department of Business Administration, University of Sufism and Modern Sciences, Bhitshah, Pakistan. Dr. Tunio has the additional role as the Director, QEC. He has more than 35 publications in peer reviewed and international journals. Dr. Tunio has a Ph.D. in Entrepreneurship, Innovation and Economic Development from Alpen Adria University, Klagenfurt, Austria. He is a teacher, researcher and administrator with varied experience in the field of Business, Management and Policy.

Vishal Dagar has a PhD in Economics [Major – Agriculture; Minor – Environment and Energy]. His research focuses on micro and macro level data sets. He uses these to predict shocks with data analysis techniques like ARDL, ARIMA, and ANN to provide the best alternatives of natural input resources. He develops production functions frontiers with SFA and DEA models to measure technical efficiency. He also uses predictive data analytics techniques, i.e., ML-AI, for treatment/simulation processes to improve productivity.

Authorship contribution statement

Erum Shaikh: Literature Review, Data Analysis, and Results. Muhammad Nawaz Tunio: Introduction, Policy Recommendation and Conclusions. Vishal Dagar: Conceived, Edited, and Conceptualization.

Conflicts of interest

The authors declare no conflict of interest.

Citation (APA Style)

Shaikh, E., Tunio, M.N., & Dagar, V. (2023). Funding liquidity on bank lending growth: The case of India. Journal of Entrepreneurship, Management, and Innovation, 19(4), 218-239. https://doi.org/10.7341/20231947

4 Hypothesis are borrowed from empirical study conducted by Dahir A. M., Mahat, Razak, & Bany-Ariffin A. N. (2018) to explore the association between bank capital, funding liquidity and BLG in emerging economies using the LSDVC approach on BRICS countries. A attemt has been made to anayse the variation in results when India is taken in Isolation and constucted a detailed anaysis and indentify the causes therof.