DOI: 10.7341/20171342

JEL CODES: C83, D61, H43, H49 /

Anna Zamojska, Associate Professor, University of Gdańsk, Department of Econometrics, 101 Armii Krajowej Str., 81- 824 Sopot, Poland, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Joanna Próchniak, Assistant Professor, University of Gdańsk, Department of Business Economics, 101 Armii Krajowej Str., 81-824 Sopot, Poland, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Abstract

Efficient infrastructure is a prerequisite of, and critical to, development. Only some projects generate a positive rate of return, but all of them should generate positive non-economic impacts and contribute social gains. Social impact is considered as a consequence or effect of decisions or interventions which lead to development. It can also be considered as a social consequence of development. The main problem of social costs and benefits is that the impact is difficult to predict and quantify and can be taken into account differently by authorities, decision makers and project developers. The main purpose of the paper is to identify and demonstrate a concept of the social impact of infrastructure projects. The principal methods used are a review of existing social science literature and surveys based on focus group interviews, devoted stakeholders of infrastructure projects, and their involvement at different stages of the project. The expected result is a set of outputs and outcomes which demonstrates social impacts (costs and benefits) related to stakeholders’ groups of the analyzed project.

Keywords: infrastructure project, social impact, cost and benefit analysis.

INTRODUCTION

Efficient infrastructure is a prerequisite and critical in the support of development. Only some projects generate positive rates of return, but all should generate positive non-economic impacts and provide social gains. Due to concerns regarding social economy phenomena and social outcomes of infrastructure, researchers have been interested in analyzing the social distribution of the costs and benefits of infrastructure projects. Social impact is considered as a consequence or effect of decisions or intervention undertaken which lead to development. It can also be considered as a social consequence of development or the issues that directly or indirectly affect people. The greatest problem of social costs and benefits is that the impact is difficult to predict and quantify and can be taken into account differently by authorities, decision makers and project developers.

Stakeholder theory, which came into being in the 1980s, states that the raison d’être of the company is to act as a vehicle for furthering the interests of its stakeholders (Freeman, Harrison, Wicks, Parmar & de Colle, 2010). In theory, organizations ought to treat all stakeholders equally (McElroy & Mills, 2007; Phillips, 2003), in accordance with the principle that “no single set of interests prevail over all others” (Mainardes, Alves & Raposo, 2012, p. 1863). However, in practice, they may not be able to meet the expectations of all stakeholders (Hartmann & Hietbrink, 2013). It follows that managements may have to prioritize stakeholders, thereby paying greater attention to the interests and expectations of certain groups (often to the detriment of others). This implies that they need to decide which stakeholders to engage with and to what extent (which is all the more relevant in view of the financial constraints faced by some organizations).

The main purpose of this paper is to identify and demonstrate a concept of the social impact of infrastructure projects. The principal methods to be used are reviews of the existing social science literature and surveys based on stakeholders groups of infrastructure projects. The expected result is a set of outputs and outcomes which demonstrates social impacts (costs and benefits) related to stakeholders’ groups of the analyzed project.

LITERATURE REVIEW

Context of social economy in infrastructure projects

Considerations on social aspects of infrastructure arise from its nature. At a very basic level, infrastructure means assets, equipment or circulating capital that serve transport, telecommunications and energy provided to the public to meet social needs and expectations. More precise definitions include buildings and installations for education, health care, culture, research, and public administration needs. If well planned and efficiently implemented, infrastructure stimulates economic development. In theory, it can be delivered by public, private or combined providers. However, in practice, infrastructure usually needs public financing preceded by positive results of social cost-benefit analysis.

At a project level, following the EU Regulation No 1303/2013, more precise classifications can be taken into account, as a project can be defined as activities, work or services intended to accomplish a specific task with clearly identified targets (Guide to Cost-Benefit Analysis of Investment Projects, 2014).

Following the literature definitions, infrastructure projects refer to structures, systems and facilities that are a prerequisite to the effective functioning of the whole economy. As it is stated in the Guide to Cost-Benefit Analysis of Investment Projects (2014), in contrast to private financed projects which should generate revenue, infrastructure projects should bring added value which come from the Europe 2020 targets – in the fields of employment, innovation, education, social inclusion and energy. If the achievement of these goals is proven, the public funds contribution from the EU in co-financing the infrastructure project can be justified for projects with low expected profitability.

Infrastructure projects can vary in the type of land use (railway, waste water treatment plant, roads, etc.), type of intervention (upgrade, construction, etc.), location or service provided (cultural activities, cargo traffic, etc.). Summing up different categories, infrastructure projects can be divided into: transport (roads, railways, air, public transport, intermodal, etc.), environmental (water, sanitation, waste management, environmental remediation, recycling, etc.), social (education, health care, etc.), energy (low-carbon energy, renewable sources, etc.), and broadband investments foreseen as internet access.

Extracting the social context of infrastructure projects, it is a prerequisite to refer to social economy and its social capital. Social economy defines choices in terms of limited resources and social purpose. On the one hand, social economy includes economic activity shaped by relationships and social processes within the local and regional economy. On the other hand, social economy includes social processes shaped by economic activity. However, the main objective of social economy is to meet social needs, solve social dilemmas and create social innovations. The social economy covers aspects such as employment, social services and social cohesion. The modern social economy provides public goods and services as important tools of local development. Hence, all types of infrastructure projects fit well into the modern social economy.

The accomplishment of the aims of the social economy can be seen in the light of at least three essential dimensions, which include: professional and social integration, stimulating the local economy and social capital, which can have many meanings (Coleman, 1998; Działek, 2011; Sandefur & Laumann, 1998; Sierocińska, 2011). Professional and social integration dimensions can be supported by infrastructure projects which include science and technology parks, technology incubators and accelerators. As stated in Poland 2030: The third wave of modernity (2013), social capital is the one which performs a variety of economic functions and is especially stimulated by infrastructure interventions to increase the presence and accessibility of culture in everyday life. Among the social capital drivers are projects which lead to the modernization and improvement of the equipment of existing infrastructure, for example, libraries. All the infrastructure projects co-financed by public funds, like EU funds, require job creation. Public intervention is justified, when the expected profitability of the project is medium or low3 and it is among the targets and objectives of EU Strategy. In the programming period 2007–2013, interventions were taken into account for projects like: ports, solid waste, roads, public transport, railways, water supply and waste water treatment plants (Guidance on the Methodology for Carrying out Cost-Benefit Analysis, 2006). Among the targets and objectives within the Europe 2020 Strategy (2010) were, for example, fully interconnected transport and cross-border energy networks.

Public financed infrastructure projects require social benefits and/or social capital in terms of the social value chain. Social capital stimulates, for instance, the effectiveness of the public sector in problem solving in relation to urbanization.

Stakeholders and their role in the social impact value chain of the infrastructure project

The general success of projects can be measured by economic indicators or financial compliance; however, infrastructure is increasingly measured by the accomplishment of the social and environmental expectations of its stakeholders. Measurement of infrastructure social goals is based on a changing role of stakeholders in the infrastructure process, as social perception and impact analysis of infrastructure in the social value chain is about stakeholders and their expectations.

The concept of stakeholders is older than it seems – some date it to the 1960s, theories relating to stakeholders became popular after the mid-1980s and most of them were and still are devoted to organizations (Aapaoja & Haapasalo, 2014; Freeman, 1984; Mitchell, Agle & Wood, 1997). Stakeholder theory evolved from a concept at a corporate level – firms managed within the value based rules (VBM – value based management) into a project level – sophisticated project management. However, the corporate perspective still dominates stakeholder research. Overwhelmingly the most popular definition is the one provided and updated by Freeman, where stakeholders are the ones who influence the corporate and are influenced by it. More examples of stakeholders’ types and attitudes are presented in Table 1.

Table 1. Stakeholder types and attitudes

|

Source (Year) |

Stakeholder types and attitudes |

|

Blair and Whitehead (1998) |

Potential cooperation Potencial risk |

|

Goodpaster (1991) |

Fiduciary Non-fiduciary |

|

Clarkson (1995) |

Primary (core) Secondary Peripheral (fringe) – not visible |

|

Mitchell et al. (1997), Bourne (2005) |

Power Urgency Legitimacy Proximity |

The concept of stakeholder management is more and more visible in infrastructure projects, but there is still a huge gap in effective stakeholder relations management (SRM), even though the potentially negative impact of stakeholders on infrastructure projects can be significant.

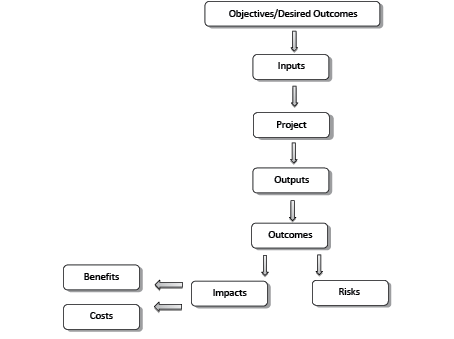

Stakeholders – their identification, typology, features, prioritization and behaviour analysis in infrastructure projects – are the key issues of the social value chain of infrastructure investments. The key issue is to understand the social value chain of an infrastructure project with a diverse and evolving role of stakeholders during the investment process. It means not only identifying the expectations (desired outcomes) of stakeholders, and the inputs and impact of the project properly, but also differentiating outputs from impacts in the value chain. The role of stakeholders is crucial, as they are the main beneficiaries of infrastructure. However, the identification, prioritization and management of evolving stakeholder groups is more complex than it seems to be. Figure 1 shows the social impact value chain divided into inputs, process, outputs and profits.

Final profits and targets of infrastructure are derived from stakeholders’ expectations. However, there is a lot of misunderstanding about what the final long-term profits (results) of infrastructure should be. Between inputs invested to achieve desired outcomes and real outcomes of the project, there are outputs which come from the direct results of the investment process. (Outcome and impact …, 2009). Because, in the whole value chain, outputs are assessed directly from the project and are the easiest ones to measure; and the primary task of infrastructure project assessment should be to figure out which outputs meet the desired outcomes and measure the outcomes in the best way.

Source: Based on Clark et. al (2004, p. 7).

Social outcomes set the medium or long term effects of project outputs and consist of risk and impact. Social impacts include the portion of infrastructure project outcomes experienced by stakeholders, excluding those which would happen without any intervention, and can be divided into: (1) processes, (2) change, (3) consequences. In practice, impacts are usually considered as positive (benefits) or negative (costs), primary or secondary long-term changes, or consequences of decisions taken which lead to development. It can also be stated as the social consequence of development or all the issues that directly or indirectly affect stakeholders. Social impacts include both intended and unintended outcomes of projects (Vanclay, 2002).

It is worth mentioning that there is no consensus in the literature, nor whether, in practice, impact defines the portion of cost and benefit outcomes or impact defines something different from outcomes. Table 2 shows a sample approach to differentiating outcomes from impacts of different infrastructure types.

In conclusion, there is no consensus of the final profits of infrastructure. However, impact indicators focus on the outcome level, while outputs focus on the direct effects of project implementation. As long as it is so difficult to measure the outcome level, because of insufficient expertise, time and costs, decision makers will focus on output level indicators and it will depend on their general knowledge which impacts are relevant for particular outputs (Burdge & Vanclay, 1996).

Using the example of a new road infrastructure, output would include the number of cars using the new road and exemplary outcome could mean a higher quality of life.

The whole process of infrastructure impact analysis should be very precise and consider a wide range of stakeholders groups. However, Vanclay (2002) notices that trying to prepare a comprehensive list of social impact can be inutile. But, according to social impact theories, attentive and smart stakeholders management should be conducted to analyze, monitor and manage the intended and unintended social consequences, both positive and negative, of planned interventions (policies, programs, plans, projects) and any social change processes invoked by those interventions.

Social impact theories derive from the early 1970s and are based on public intervention which is prerequisite to ensure development and better development outcomes (Jacquet, 2014; Vanclay, 2003)4. A formalized set of good practices was developed and formalized in the US in the 1970s as the Social Impact Assessment, however surveys of McKinsey & Company state that the history of SIA started in the 1950s (McKinsey on Society). It seems that the term SIA was first used by the Department of the Interior when an Environmental Impact Statement was prepared (McKinsey on Society). As Jacquet notices (2014), social impact concerns were derived from widespread energy development, including oil, natural gas, coal and uranium. In 1992 the Inter-Organizational Committee on Guidelines and Principles for Social Impact Assessment (SIA) was formed to propose a set of principles. Then, after the past few years, the SIA idea expanded in an international context to increase the value of implementation processes.

It seems that most significant drivers for the expansion of Social Impact were the international agreements of Environmental Impact Assessments, the growing role of the World Bank, International Monetary Fund, International Finance Corporation (IFC) and other international finance providers which adopted The Equator Principles5 – risk management frameworks for managing environmental and social risks and impacts in large and industrial projects in a structured way.

A lot of international institutions like the World Bank or International Monetary Fund demand strict socio-economic profits and effects for the awarded money. Probably, the World Bank (WB) was the first institution to operationalize the concept of social outcomes. The aim of the Social Capital Initiative (SCI), funded by the Government in Denmark and launched by World Bank in 1996, was to assess the impact of social capital of development projects and to contribute to methodologies for practical tools in measuring the social impact and social capital (Brootaert & Bastelaer, 2001). The Bank’s current policies were issued over 20 years ago, and the latest social framework (Environmental and Social Framework) was approved on 4th of August 2016.

Table 2. Exemplary outcomes and impacts of different infrastructure projects

|

Outcomes |

Impacts |

|

|

Roads |

Lower road transport time Lower road transport costs Implementation and enforcement of laws related to roads Increased employment |

Specific impacts Greater economic accessibility: access to roads – population living within x-kilometres of the road use of public transportation (number of people using public transportation) business productivity (market return for traded goods, transfer to higher-value goods) Greater accessibility to social services (schools, health care, local governmental offices) environmental effects of road systems (soil erosion, lead and carbon pollution, market share for unleaded petrol) enhanced safety & health linked to roads road deaths and injuries (number of deaths, road injuries) disease transmissions influenced by improved mobility Intermediate impacts Improved conditions for economic growth Employment opportunities Trade (volume and value of trade between regions) Enhanced Human Capital School attendance Health attendance (number of visits to health centers, number of supervised births) Global impacts Economic Growth Social Development Poverty reduction |

|

Water/ Sanitation |

Improved conservation and preservation of water Availability of water (change in water levels) Preservation of water (protected areas) Improved use of water and sanitation Irrigation requirements (amount of water necessary to produce food) Water leakages (water lost through water systems) Recycling of water (amount of recycled water) Increased employment due to construction and maintenance Improved quality of water and sanitation Pollution of water and soil (level of chemicals, minerals, metals, pesticides, etc) Treatment of waste water Greater equity in allocation of water and sanitation (rate of connection to water network to national average) Equity in allocation of water between sectors Increased affordability of water and sanitation Household expenditure on water and sanitation Cost of water for business |

Specific impacts Improved water and sanitation health and hygiene behavior lead by awareness Increased access to safe water Domestic access to safe water (number of households connected to water network) Business access to water (% of industrial water needs met) Increased access to basic sanitation (number of people with access to sanitation) Specific/intermediate impacts Improved conditions for economic growth Intermediate impacts Sustainable national water supply Reduced rate of water related diseases |

Source: Outcome and impact level indicators water and sanitation sector (2009), Outcome and impact level indicators road sector (2009).

Following F. Vanclay’s presentations, among the formalized examples are: the World Bank Environmental and Social Framework, International Finance Corporation Performance Standards, OECD Guidelines on Multinational Enterprises, UN Principles for Responsible Investment, and UN Global Conduct (Vanclay, 2012). In contrast with some forms of impact assessment like environmental, which was adopted in the European SEA Directive 2001/42/EC, social and health issues are still not legally mandated in most jurisdictions (Pope et. al., 2013). Social aspects are categorized by: standards, assessments, codes of conduct or guidelines.

Unfortunately, there is still no sufficient data and methodology for modelling social outcomes, especially impacts. It allows for flexibility and context approaches, although cost-benefit methodology seems to be the most commonly implemented as an economic appraisal tool of infrastructure project evaluation. This can be confirmed by the obligatory use of the EU Guide to Cost-Benefit (2014) in all public financed investments projects.

RESEARCH METHODS

Sample and data collection

The subject of the research was the Exhibition and Congress Center of the Gdańsk International Fair Co, AmberExpo. This infrastructure project consists of exhibition halls, an office building with conference center and VIP area, a press center and service areas, parking and an exhibition area. The AmberExpo project was implemented in 2011-2012 by the investor, Gdańsk International Fair Co. The complex is an example of an infrastructure project in the third stage of an investment, i.e. the stage of use of an infrastructure facility. AmberExpo is operated by MTG, a company owned by the municipality and headed by the president of the city, which co-operates with the city council. Both the president and the councillors are directly elected by city residents every four years. The municipality favours participatory forms of urban governance. From this point of view, it is important to know how to assess the effects of managing an infrastructure project, which aims to improve the quality of life in society.

A self-report paper-and-pencil questionnaire was used to collect data from different Gdańsk International Fair Co stakeholders belonging to the following stakeholder groups: (FAM) firms located at AmberExpo; (FG) firms located in Gdańsk; (FL) firms located in Letnica; (MG) residents of Gdańsk; (ML) residents of Letnica; (MTG) employees of MTG; (OT) visitors (only from outside Gdańsk) at an event (“FIT Festival”) held at AmberExpo in February 2016; (WT) firms (only from outside Gdańsk) participating in “FIT Festival”. A total of 820 responses were collected, of which 23 were deemed incomplete. Consequently, 797 responses were used for further analysis. It should be noted that of our sample 57% were female. Moreover, 25% of respondents were aged 25 years or less, 20% were between 26 and 40, and 55% were over 41. As for businesses, 70% of the firms in our sample employed less than nine workers, 27% employed between ten and 49 people, and 3% more than 50. As regards the age of the firms, 8% were less than a year old, 35% were between one and five years old, 35% were between six and 10 years old, and 22% were more than 11 years old.

The sampling procedure varied depending on the stakeholder group. Specifically, as for (MG) and (ML), we used a two-stage approach. The first stage consisted of randomly selecting a street. At the second stage, systematic sampling was applied to select a flat (i.e., every fifth flat). As for (FG), we randomly selected companies from a register, known as the National Official Register of the Territorial Division of the Country (TERYT). As for (FAM) and (FL), all firms (based on TERYT) were included (i.e., full sample). The same goes for (WT). As for (MTG), systematic sampling was used (i.e., every second employee). Finally, we applied accidental sampling to (OT).

Measurement

A key step in measuring the positive impact (social benefits) and negative impacts (social costs) of a project is to define a set that will be different for each project. Additionally, it should be noted that it is necessary to decompose social benefits and costs into external (objective) and subjective perceptions perceived by each stakeholder. The key thesis of the proposed approach is that the difference between social benefits and costs is always positive and thus increases the economic value of the project. Our study showed that project stakeholders often fail to identify all the benefits and costs, both external and subjective.

We measured outputs, outcomes as effects of outputs, positive impact - benefits (outcomes to stakeholders) and negative impacts – costs with the following items (Table 3):

Table 3. Items used to measure the social costs and benefits of the MTG stakeholders

|

Outputs |

Outcomes as effects of outputs |

Positive impact – Benefits |

Negative impacts – Costs |

|

Local district infrastructure development Transport improvement Access to events Parks and green areas Playgrounds and recreation areas |

Increase of real estate market value Advertising spaces Development of local services Tax increase Increased aesthetics of green spaces |

Better education facility Better culture access Higher tourist attractiveness of the city Integration of business clusters |

Higher traffic Higher pollution Vibration and noise from traffic Newcomers to the local community |

|

Very well equipped Amber Expo infrastructure New industrial building Rebuilding of water system preservation Renovation of local railway station |

High traffic Lower road transport costs Increased level of water and sanitation Better communication accessibility Better public transport access to the district Culture centre |

Better quality of life Higher tax incomes to local budget Enhanced safety Greater economic accessibility Greater accessibility to local services Employment opportunities |

The fractions of the items/variables for different group of stakeholders are presented in Table 4.

According to the given responses, 100% of firms located exactly at Amber Expo perceive outputs of the new infrastructure Exhibition Centre, but only 18% of firms located in the Gdańsk area. In the case of outcomes as effects of outputs, the highest fraction 72% refer to employees of MTG and almost the same (65%) refer to residents of Letnica. The lowest level of outcomes was noticed by firms located in the Gdańsk area (21%).

Table 4. Fractions of the items of the MTG stakeholders (%)

|

Stakeholder |

n |

Outputs |

Outcomes as effects of outputs |

Positive impacts – Benefits |

Negative impacts – Costs |

|

FAM |

4 |

100 |

50 |

75 |

25 |

|

FG |

39 |

18 |

21 |

18 |

18 |

|

FL |

37 |

49 |

54 |

51 |

16 |

|

MG |

400 |

31 |

27 |

16 |

8 |

|

ML |

113 |

52 |

65 |

58 |

12 |

|

MTG |

25 |

52 |

72 |

60 |

20 |

|

OT |

106 |

27 |

27 |

39 |

28 |

|

WT |

65 |

49 |

37 |

25 |

32 |

The Spearman correlation ratio, which equals 0.82, reveals that there is a high positive relationship between perception of outputs and outcomes among analyzed stakeholders groups. It allows us to formulate the hypothesis that the higher the level of outputs (and outcomes) perception by the stakeholders group, the better the perception of positive impacts – benefits (respectively Spearman ratio equals 0.85 and 0.78). There is no evident relation between outputs (outcomes) and negative impacts (costs).

In view of the foregoing, the Social Relation Management team should consider stronger interests in reference to those stakeholders who, to a greater extent, notice outputs of the project. This conclusion is consistent with the theory, which states that positive outcomes should maximize rather than minimize negative effects.

ANALYSIS

The present study draws on data collected among stakeholders of Gdańsk International Fair Co (MTG – a company that is controlled by the municipality of Gdańsk (Poland) and operates a big exhibition centre called AmberExpo). This facility, financed by taxpayer’s money, is located in Letnica, one of the city’s most disadvantaged neighbourhoods. We proposed to investigate the relationship between MTG and its stakeholders through the lens of social costs and benefits analysis (Dompere, 1995), which may be viewed as a general framework for the analysis of private and social decisions to correctly account for possible costs and benefits.

Cost-benefit analysis (CBA) is the main tool used in welfare economics in order to assess whether a project should be undertaken (Levin & McEwan, 2001). The criterion for a project to be considered is that its benefits outweigh its costs6. The question, however, is broader than financial costs and is whether benefits that are not reflected in the ‘market terms’ such as social effects should be taken into account?

Social costs-benefits analysis (SCBA) refers to cases where the project has a broad impact across society. Such projects have one set of costs and benefits that may be measured in terms of their price in money and also changes in individual utility and total social welfare that is not easily quantifiable. As an idea SCBA is extremely simple: evaluate costs C and benefits B for the project under consideration and proceed with it if, and only if, benefits match or exceed the costs. In practice SCBA is quite complex. The complexity of the SCBA is related to a number of different factors that are difficult to measure. We can state that social costs and benefits:

- Usually relate to different sets of stakeholders. So the way of aggregation and comparison of different costs and benefits across different sets of stakeholders should be done separately.

- May occur at different points in time. In this case we need to compare the value of outcomes at different points in time.

- May relate to different types of products (goods or services or others) and it may be difficult to compare their relative values.

- May be (and usually are) uncertain.

- May be difficult to price and, as a result, there may be different effects of pricing.

As we can see from the above, the process of pricing all of the factors that should be involved in a costs and benefits analysis for a given project is complex and difficult to quantify. Furthermore, this quantification only makes sense on a case-by-case basis. It is not difficult to note, for example, that there is a vast difference between the construction of a road and the construction of sewage treatment plants.

DISCUSSION

A wide range of issues come with social costs and benefits in the social impact value chain. The greatest problem of social costs and benefits is that the impact is difficult to predict and quantify and can be taken into account differently by the authorities, decision makers and project developers. Social impacts can vary in every project, so modelling is still a current and important research topic. However, many of the social impacts of the planned intervention (infrastructure projects) can be well predicted.

The next obstacle is to understand and differentiate outputs from costs and benefits. Many costs and benefits are misleading in their direct effects on projects. The distribution of costs and benefits of development and infrastructure projects is not equal across the community. So, identifying social impact is the main concern with the social distribution of costs and benefits among the stakeholders.

Most projects bring newcomers to the community (new community stakeholders) with differences in values, attitudes and behaviours, so the project generates additional social values. One of the findings and discussion issues is that some impacts can be perceived as negative (costs) by some members of the community, but positive (benefits) by others, as it is the subject of individual judgements. The statement whether the impacts are positive or negative may be more complex, as the judgement may change during the investment process. Some impacts may also be excluded.

CONCLUSION

This research work, while applying social costs-benefits analysis to the explanation of stakeholder behaviour, has incorporated the social impact of the infrastructure project into the analysis and conceived of stakeholder relationship as inherently nested. Social impact is considered as a consequence or effect of decisions or interventions undertaken which lead to development. It can also be considered as a social consequence of development or the issues that directly or indirectly affect people. The greatest problem of social costs and benefits is that the impact is difficult to predict and quantify and can be taken into account differently by authorities, decision makers and project developers. At the same time, our study offers several practical insights of particular interest to municipalities and municipality-controlled companies planning to improve the way they manage the relationship with their diverse stakeholders. The main purpose of this paper was to identify and demonstrate a concept of the social impacts of infrastructure projects and as a result we obtained a set of outputs and outcomes which demonstrates different social impacts (costs and benefits) for the project. Applying a measure of consistency reveals that there is a high positive relationship between the perception of outputs and outcomes among analyzed stakeholders groups. It allows us to formulate the hypothesis that the higher the level of outputs (and outcomes) perception by the stakeholders group, the better the perception of positive impact – benefits. So Social Relation Management should consider stronger interests in reference to those stakeholders who notice outputs of the project to a greater extent. This conclusion is consistent with the theory, which states that positive outcomes should maximize rather than minimize negative effects.

As in the vast majority of research projects, this study has a number of limitations that ought to be acknowledged. One of them is that it relies solely on self-reports, which suggests that caution is in order while interpreting and generalizing the findings. But these limitations provide opportunities for further research.

Acknowledgments

The article came into being within a research project supported by the National Centre of Research and Development under the programme ‘Social Innovations’ (IS-2/88/NCBR/2015); title: Innovative Model of Socioeconomic Benefits and Costs in Infrastructural Projects.

References

Aapaoja, A., & Haapasalo, H. (2014). A framework for stakeholder identification and classification in construction projects. Open Journal of Business and Management, 2, 43–55.

Burdge, R., & Vanclay, F. (1996). Social impact assessment: A contribution to the state of the art series. Impact Assessment, 14(1), 59–86.

Clark, C., Rosenzweig, W., Long, D., & Olsen, S. (2004). Double Bottom Line Project Report: Assessing Social Impact In Double Bottom Line Ventures. Rockefeller Foundation. Retrieved from http://www.riseproject.org/DBL_Method_Catalog.pdf

Coleman J.S. (1998). Social capital in the creation of human capital. American Journal of Sociology, 94, 95–120.

Dompere, K.K. (1995). The theory of social costs and costing for cost-benefit analysis in a fuzzy-decision space. Fuzzy Sets and Systems, 76(1), l–24.

Działek J. (2011). Kapitał społeczny – ujęcie teoretyczne i praktyka badawcza. Studia Regionalne i Lokalne, 3(45), 100–118.

Europe 2020. A European Strategy for smart, sustainable and inclusive growth. European Commission, COM (2010) 2020, 3.3.2010, Brussels.

Freeman, R.E. (1984). Strategic Management: A Stakeholder Approach. Boston: Pitman.

Freeman, R.E., Harrison, J.S., Wicks, A.C., Parmar, B.L., & de Colle, S. (2010). Stakeholder Theory: The State of the Art. Cambridge: Cambridge University Press.

Grootaert, Ch., & Bastelaer, T. (2001). Understanding and measuring social capital: A synthesis if findings and recommendations from the social capital initiative. Social Capital Initiative Working Paper, 24.

Guidance on the Methodology for Carrying out Cost-Benefit Analysis (2006). The New Programming Period 2007–2013, European Commission. Working Document, 4.

Guide to Cost-Benefit Analysis of Investment Project, Economic appraisal tool for Cohesion Policy 2014–2020 (2014). European Commission, Working Document, 15–40.

Hartmann, A., & Hietbrink, M. (2013). An exploratory study on the relationship between stakeholder expectations, experiences and satisfaction in road maintenance. Construction Management and Economics, 31(4), 345–358.

Jacquet, J.B. (2014). A Short History of Social Impact Assessment, Department of Sociology and Rural Studies. Montana: South Dakota State University.

Levin, H.M., & McEwan, P.J. (2001). Cost-Effectiveness Analysis. Methods and Applications. London: Sage Publications.

Mainardes, E.M., Alves, H., & Raposo, M. (2012). A model for stakeholder classification and stakeholder relationships. Management Decision, 50(10), 1861–1879.

McElroy, B., & Mills, C. (2007). Managing stakeholders. In J.R. Turner (Ed.), Gower Handbook of Project Management (pp. 757–777). Aldershot: Gower Publishing.

Mitchell, R.K., Agle, B.R., & Wood, D.J. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. The Academy of Management Review, 22(4), 853–886.

Outcome and impact level indicators road sector (2009). EC External Services Evaluation Unit, Working Paper.

Outcome and impact level indicators water and sanitation sector (2009). EC External Services Evaluation Unit, Working Paper.

Phillips, R. (2003). Stakeholder Theory and Organizational Ethics. San Francisco, CA: Berrett-Koehler Publishers Inc.

Polska 2030. Trzecia fala nowoczesności. Długookresowa Strategii Rozwoju Kraju (2013). Warszawa: Ministerstwo Administracji i Cyfryzacji.

Pope, J., Bond, A., Morrison-Saunders, A., & Retief, F. (2013). Advancing the theory and practice of impact assessment: Setting the research agenda. Environmental Impact Assessment Review, 41, 1–9.

Sandefur, R., & Laumann, E.O. (1998). A paradigm for social capital. Rationality and Society, 10, 481–501.

Sierocińska, K. (2011). Kapitał społeczny. Definiowanie, pomiar, typy. Studia Ekonomiczne 1(68), 69–86.

The Green Book: Appraisal and Evaluation in Central Government. (2016). London: Treasury Guidance, HM Treasury,

US Presidential Executive Order 12291 (1981). The National Archives and Records Administration.

Vanclay, F. (2003). International principles for social impact assessment. Impact Assessment and Project Appraisal, 21(1), 5–11.

Biographical notes

Joanna Próchniak – Ph.D., Assistant Professor of Economy at the Faculty of Management, University of Gdańsk. Her research interests focus on: financing in the SME’s sector, value based management with a focus on business process offshoring and social aspects in creating corporate value (for example: social value, social impact, social corporate responsibility, non-financial reporting). She conducts classes in business economics, financing SME’s, and venture capital.

Anna Zamojska – Ph.D., Associate Professor of Economy and Finance at the Faculty of Management, University of Gdańsk where she conducts research and courses in Econometrics, Forecasting and Statistics. Currently, she is focused on the following issues: Uncertainty Modelling, Corporate Governance and Financial Performance of Companies, Econometrics of Financial Markets. She has worked in industry and business consulting for many years, specializing in the field of quantitative research and analysis.

1 Anna Zamojska, Associate Professor, University of Gdańsk, Department of Econometrics, 101 Armii Krajowej Str., 81-824 Sopot, Poland, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

2 Joanna Próchniak, Assistant Professor, University of Gdańsk, Department of Business Economics, 101 Armii Krajowej Str., 81-824 Sopot, Poland, e-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Received 12 May 2017; Revised 18 October 2017; Accepted 9 November 2017.

3 Projects with (Economic Net Present Value) ENPV<0.

4 Generally, impact assessments have been practiced for over 40 years, now with at least six well-established ones: Environmental Impact Assessment (EIA), Strategic Environmental Assessment (SEA), Policy Assessment, Social Impact Assessment (SIA), Health Impact Assessment (HIA) and Sustainability Assessment (Pope et al., 2013, p.1, 2). Fundamentals of impact assessment have roots in environmental issues and US National Environmental Policy Act (NEPA) dated on 1969.

5 Equator Principles were adopted by 85 financial institutions among 35 countries, covering over 70% of international Project Finance debt in emerging markets – Equator Principles Financial Institutions (EPFIs). Institutions operating in Poland have not adopted the principles. More info: http://www.equator-principles.com.

6 In some countries, undertaking a cost-benefit analysis for appraising public projects is mandatory, for example the US Presidential Executive Order 12291, or HMT guidance in the UK.